尊龙凯时app的公告

【上商学术沙龙第47讲】what doesn’t kill you may make you overconfident: ceo gender and mergers and acquisitions in china

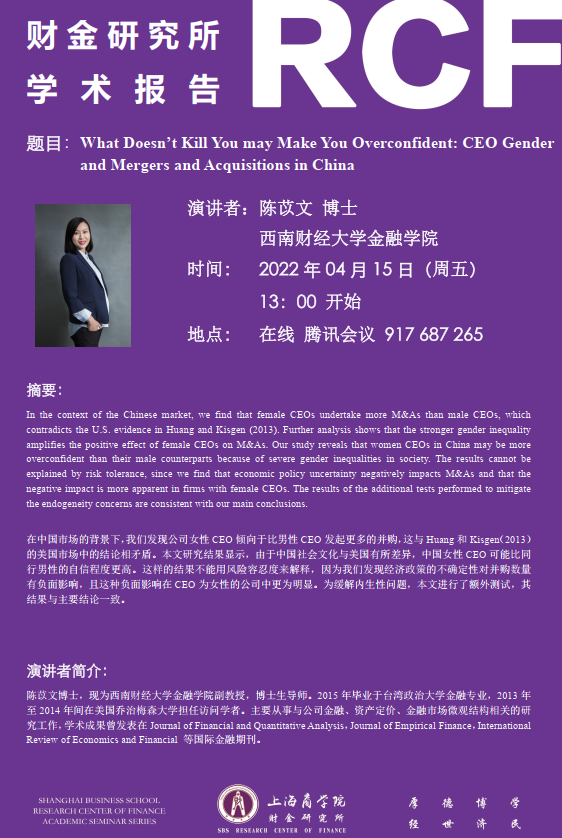

题目:what doesn’t kill you may make you overconfident: ceo gender and mergers and acquisitions in china

演讲者:陈苡文 副教授 西南财经大学

时间: 2022年4月15日 13:30

地点: 在线,腾讯会议 917 687 265

内容摘要:

in the context of the chinese market, we find that female ceos undertake more m&as than male ceos, which contradicts the u.s. evidence in huang and kisgen (2013). further analysis shows that the stronger gender inequality amplifies the positive effect of female ceos on m&as. our study reveals that women ceos in china may be more overconfident than their male counterparts because of severe gender inequalities in society. the results cannot be explained by risk tolerance, since we find that economic policy uncertainty negatively impacts m&as and that the negative impact is more apparent in firms with female ceos. the results of the additional tests performed to mitigate the endogeneity concerns are consistent with our main conclusions.

在中国市场的背景下,我们发现公司女性ceo倾向于比男性ceo发起更多的并购,这与huang和kisgen(2013)的美国市场中的结论相矛盾。本文研究结果显示,由于中国社会文化与美国有所差异,中国女性ceo可能比同行男性的自信程度更高。这样的结果不能用风险容忍度来解释,因为我们发现经济政策的不确定性对并购数量有负面影响,且这种负面影响在ceo为女性的公司中更为明显。为缓解内生性问题,本文进行了额外测试,其结果与主要结论一致。

演讲者简介:

陈苡文,副教授,博士生导师。2015年毕业于政治大学金融专业,2013年至2014年间在美国乔治梅森大学作访问学者,2016年进入西南财经大学金融学院任教。主要从事与公司金融、资产定价、金融市场微观结构相关的研究工作,目前已取得数篇学术成果,文章发表在journal of financial and quantitative analysis,journal of empirical finance,international review of economics and financial 等国际金融期刊。